Enjoy Your Golf More and Play Better

Join our growing Golfing Focus community where we spend the time you don’t have researching the game and the gear to leave you free to simply enjoy playing and improving your golf!

How Long Does a Round of Golf Take – for 1, 2, 3 & 4 Players?

The Rules of Golf changed a lot on 1st January 2019 with many of the new rules intended…

Is Hitting Golf Balls Into a Net Good Practice? Feel is Key!

If you’re like me and this year has resulted in much more working from home than normal you’ve…

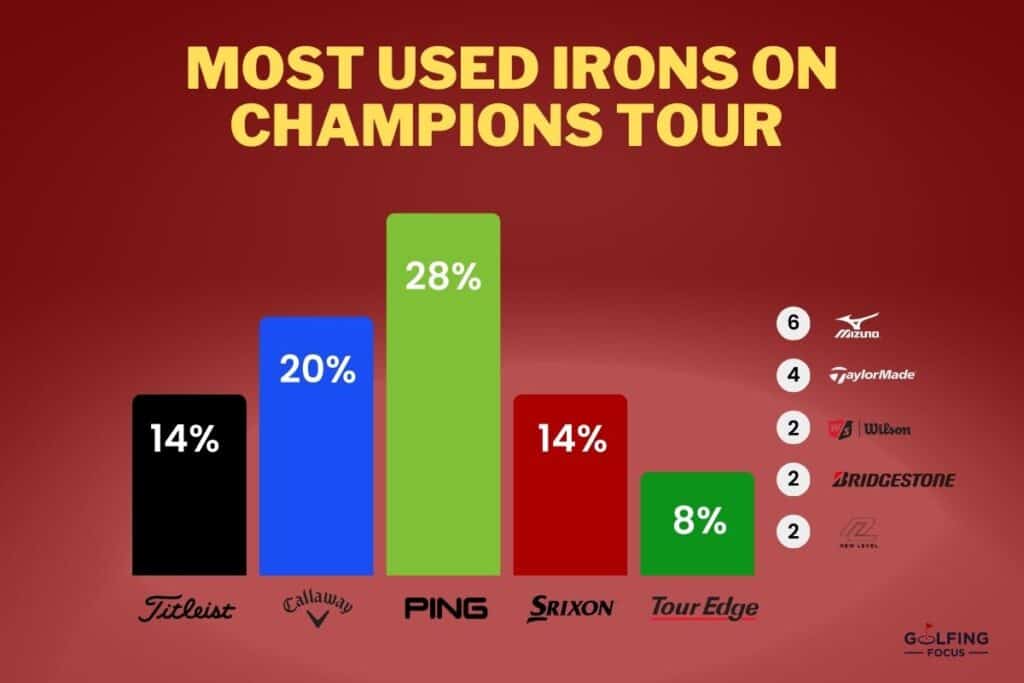

Champions’ Choice: The Most Used Irons on the Champions Tour (2024)

Having looked previously at the iron choices of the top pros on the PGA and LPGA Tours this…

Hybrids vs. Fairway Woods – FULL Distance and Comparison Guide

The introduction of golf hybrids over the past couple of decades has given golfers a genuine alternative to…

PIECES OF GREAT CONTENT

FOLLOWERS

VIEWS ACROSS PLATFORMS

ENJOYING GOLF

Golfing Focus Favourite Golf Products of All Time

These items are battle-tested and can be recommended without equivocation.

And these products are not simply all the high-end golf gear.

We don’t consider anything we haven’t tested ourselves and all we want to do is simply recommend golf stuff that is priced really well and still of good quality.

Check out the Golfing Focus YouTube Channel

Our videos have gathered more than 2 million views covering all aspects of this great game.